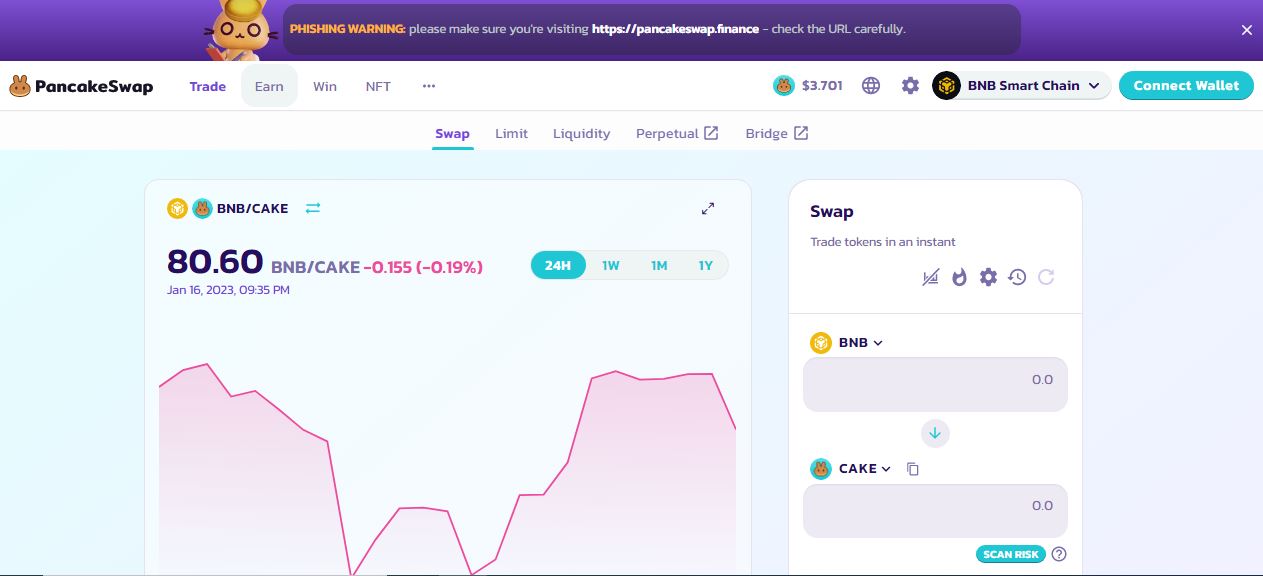

Centralized Exchanges Versus Decentralized Exchanges. Centralized exchanges are digital platforms where users can buy and sell cryptocurrencies. Decentralized exchanges, on the other hand, are built on blockchain technology and operate on a peer-to-peer basis.

Centralized Exchanges Versus Decentralized Exchanges. Centralized exchanges are digital platforms where users can buy and sell cryptocurrencies. Decentralized exchanges, on the other hand, are built on blockchain technology and operate on a peer-to-peer basis.

You cannot copy content of this page